MAKING TAX DIGITAL

What is Making Tax Digital (MTD)

Making Tax Digital (MTD) is part of HMRC’s vision to digitalise the UK’s tax system and make it easier for businesses and individuals to keep on top of their taxes.

All businesses with a taxable turnover above the VAT registration threshold are required to submit their VAT Returns electronically, via MTD compliant software.

VAT Bridging Software recognised by HMRC*

To purchase your 12-month subscription for LJT-MTD please click here

LJT-MTD User Guide (Download)

*You must make sure you provide your VAT registration number in order to use this product.

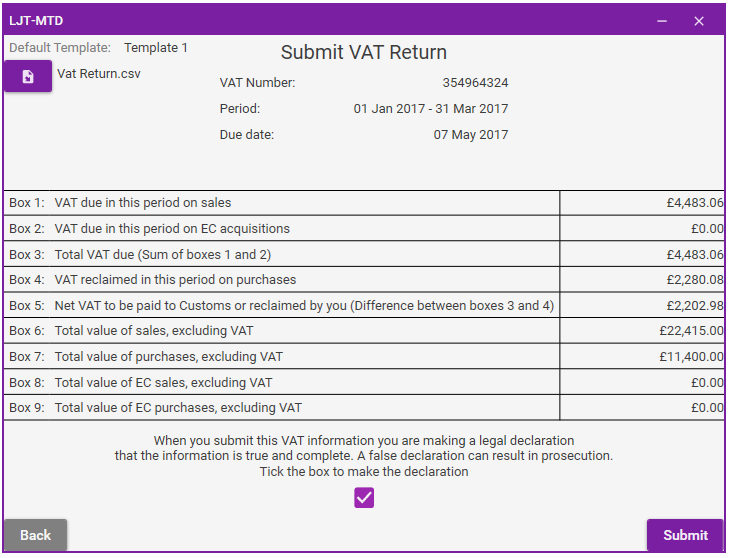

Submitting Process

Submitting a VAT Return is as easy as 1-2-3.

- Upload your VAT Report to LJT-MTD. The data will automatically be imported, based on your chosen template. Only CSV files are currently supported.

- Preview the data imported in the Boxes 1 to 9.

- When ready, submit your VAT Return directly to HMRC via the Making Tax Digital API.

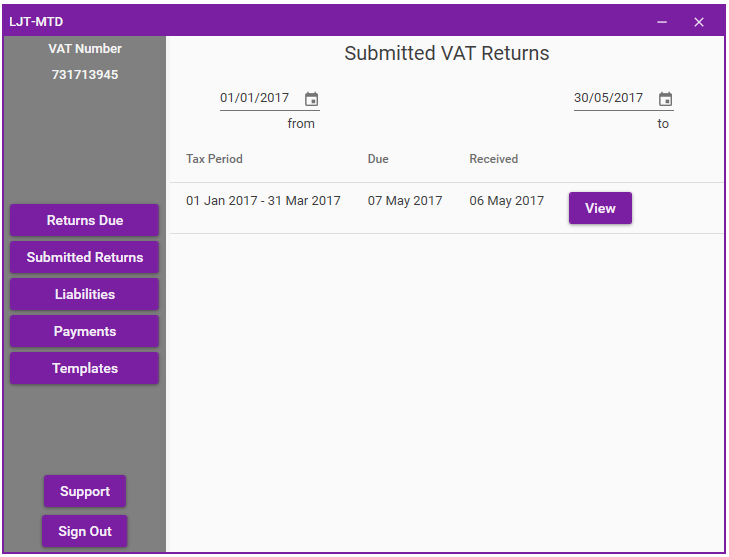

Real-Time Reporting

We connect directly to HMRC to show your VAT Liabilities, Payments, and previously submitted VAT Returns. Only VAT Returns that have been submitted via MTD will appear.

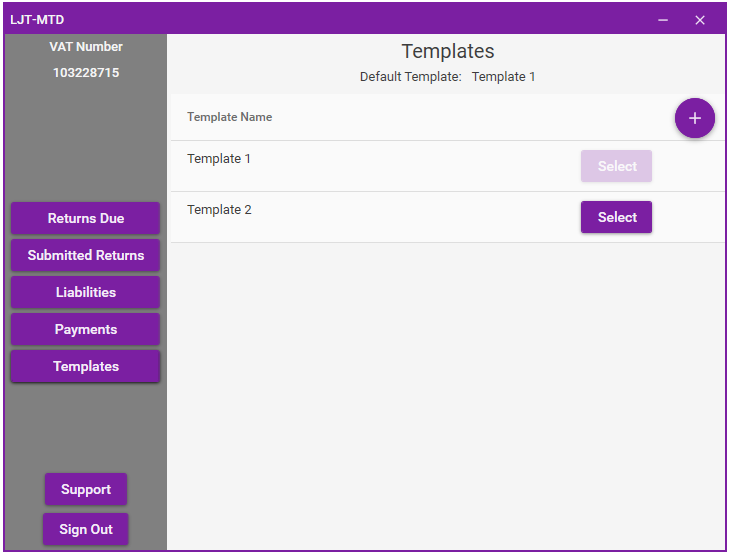

Templates

Templates in LJT-MTD are used to help correctly import the data from the uploaded VAT Report, when submitting a VAT Return.

LJT-MTD comes with defined templates pre-installed, which are compatible with popular account packages.

If your template is not listed, please do not hesitate to contact us and we will get that added for you.

For assistance in completing VAT return after Brexit please click the link below.

00174 LJT Making Tax Digital – VAT return notes after Brexit – LJT Systems LTD

To purchase your 12-month subscription for LJT-MTD please click the link below which will take you to our ecommerce.

LJT – MTD (Making Tax Digital) 12 Month Subscription

£47.99